Meager Tax Savings in '06 (But Taxpayers Gain in '05)

2005-2006 Tax Savings

2005 Payroll Taxes

Employee Employer Payroll Contributions

Ottawa: The Canadian Taxpayers Federation (CTF) today released calculations of personal income and payroll tax savings that will come into effect on January 1st, 2006. Also included are retroactive personal income tax changes - which apply to the 2005 tax year - announced by the finance minister in the November economic update. The CTF tax calculations include those measures being administered by the Canada Revenue Agency, and apply regardless of the federal election outcome.

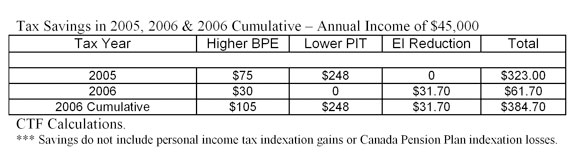

"Federal tax reductions will give all taxpaying Canadians some relief in '05 and '06," said CTF federal director John Williamson. "Lower income taxes and employment payroll taxes will give the average taxpayer a net gain of $62 in 2006. However, last minute personal income tax changes announced in November will result in the average taxpayer savings $323 in 2005. Because these tax reductions are built into the tax code they roll into the next year. As a result, cumulative tax savings in '06 will be $385."

Personal Income Tax Reductions and Savings (2006 and 2005)

In 2006 the basic personal exemption (BPE) - which is the amount an individual earns before paying federal income taxes - will increase by $200 above the inflation rate (this change plus indexation will boost the BPE to $9,039 next year). This measure will save all taxpayers an additional $30 per year starting in 2006.

The November economic update increased the BPE by $500 (from $8,148 to $8,648), and lowered the bottom personal income tax bracket from 16 per cent to 15 per cent. Both measures kicked in retroactively to January 1st, 2005. Together, they will save all taxpayers earning $35,595 or more $323 a year, starting in 2005. (The BPE change results in a $75 savings and the lower tax rate translates into a $248 savings. Chart 1 highlights the tax changes for various income levels and for the 10 provinces.)

2006 Employment Insurance Reductions and Savings

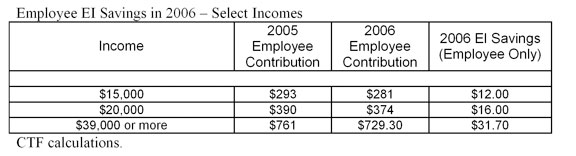

Effective January 1st, 2006, Employment Insurance (EI) premium rates will drop by eight cents to $1.87 for employees (per $100 of insurable earnings) from the current rate of $1.95. The corresponding employer rate will drop by 11 cents to $2.62 from the current rate of $2.73. These EI changes represent a 4.1 per cent reduction from 2005 levels. (The maximum insurable earnings will remain unchanged at $39,000 for 2006.)

Unfortunately, the net payroll tax bill will increase because EI reductions will be gobbled up by the Canada Pension Plan payroll tax. CPP premium rates (per $100 of insurable earnings) will remain unchanged at 4.95 per cent paid by employees and 4.95 per cent paid by employers. Yet because the threshold will increase to $42,100 in 2006 from today's $41,100 level, workers will pay $50 more in CPP taxes next year. (See Chart 2 for 2006 and historical payroll tax changes.)

And There is More to Come-

The two major political parties - the governing Liberals and opposition Conservatives - have each promised to lower taxes if elected on January 23rd. Prime Minister Paul Martin has said he will lower income taxes on the middle class - although has yet to provide any details. Opposition leader Stephen Harper will reduce the 7 per cent GST to 5 per cent, and he has also hinted at additional income tax relief. There are few votes to be won by way of higher taxes: Even New Democrat leader Jack Layton says his party will not raise taxes.

"Voters need to nail down the Liberal and Conservative tax reduction proposals before Election Day. Yet the fact both major parties are talking about tax cuts is good news for overtaxed Canadians," continued Williamson. "This is mainstream recognition that Canadians have been suffering under an unnecessarily high tax burden."

Why Suffering Taxpayers Need a Break

Structural over-taxation occurs when a government consistently collects more revenues than it needs to meet its annual funding commitments. As Canadians have suffered from high taxes and income stagnation, government coffers have overflowed. Ottawa is running multi-year and multi-billion dollar surpluses. Studies have shown that after-tax household incomes have increased only 3.8 per cent in the last twenty five years while federal government revenues increased 372 per cent over the same period.

"The federal government is swimming in excess surplus money, while ordinary taxpayers have barely kept their head above water," concluded Williamson. "A surplus is nothing more than over-taxation. It is high time for Ottawa to throw a lifeline and return surplus money back where it belongs, to Canadian taxpayers."